Patients seeking elective surgery can choose surgeons and facilities that are covered by their insurance (“in-network”). However, they are unable to choose other providers who may be involved in their care. If these providers are out-of-network and the patient’s insurance company does not reimburse them for the entire amount charged, the patient may be sent a balance bill for the difference. This is considered an unexpected, or “surprise,” medical bill.

February 2020

Snapshot of findings

A team at the University of Michigan has been one of the first to study the drivers of surprise billing in the surgical setting; most prior research has focused on emergency services or general inpatient care.

20%

of patients undergoing a common elective procedure received an out-of-network bill—a “potential surprise bill”. i

$2,011

Average size of a

potential surprise bill.ii

were most commonly involved with out-of-network bills (each in 37% of episodes that had an out-of-network bill).

i. “Potential” refers to the fact that our data do not indicate whether a balance bill was sent to the patient from the out-of-network provider after the insurance plan’s payment.

ii. These are calculated as the total out-of-network charges within each episode, less the payment that the insurance plan would typically make for the same services if they were in-network.

Takeaways from our research on out-of-network bills in elective surgery

Methods: In a study using claims data from a large U.S. commercial insurer, we identified patients who had undergone an elective procedure [including knee replacement, coronary artery bypass grafting (CABG), hysterectomy, among others] by an in-network primary surgeon at an in-network facility between 2012–2017. Seven common elective procedures were included in the analysis, representing 347,356 patients.1

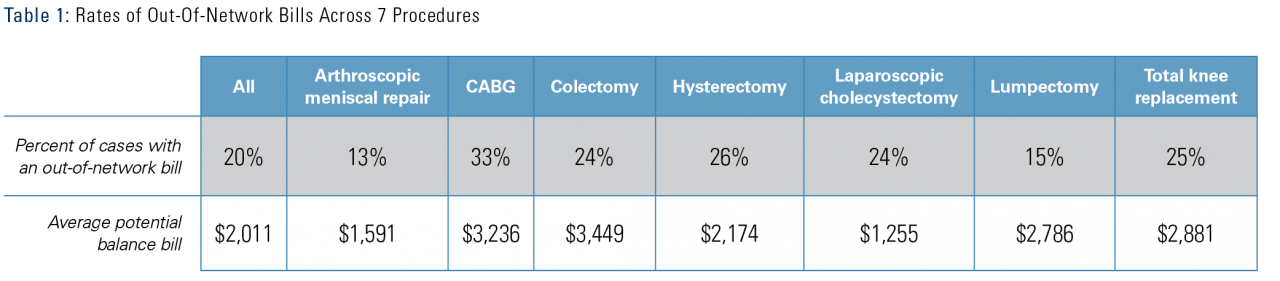

The rate of out-of-network bills varied by:

- Procedure (Table 1)

- Inpatient procedures (e.g., hysterectomy, knee replacement, colectomy, CABG) had out-of-network bills in 24-33% of cases versus simpler outpatient procedures (meniscal surgery, breast lumpectomy) had an out-of-network bill in 13-15% of cases.

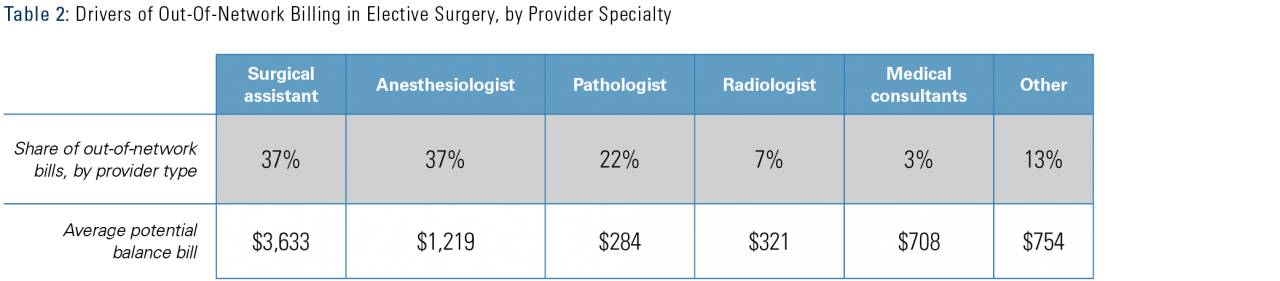

- Provider type (Table 2)

- 37% of surgeries with an out-of-network bill had an out-of-network claim from a surgical assistant (including surgeons, physician assistants, and nurses).

- 37% from an anesthesiologist.

- 22% from a pathologist.

- Insurance type

- The risk of an out-of-network bill was 6 percentage points higher in an Exchange Plan than in other plan types, possibly due to narrower networks compared to employer-sponsored plans.

- The risk was 3 percentage points lower for patients in self-insured plans than in fully insured plans.

- Complication rate

- The risk of an out-of-network bill was 7 percentage points higher for patients with one complication, compared to those with no complications.

- The risk of an out-of-network bill was 14 percentage points higher for patients with two complications, compared to those with no complications.

In a subsequent analysis focused on four common orthopedic procedures iii, we found:2

- Nearly 20% of orthopedic procedures involved an out-of-network bill. These were often for charges from third-party companies, such as for durable medical equipment, physical therapy, and nerve monitoring.

-

The rate of out-of-network bills varied by provider type.

-

39% of procedures with an out-of-network bill had a claim from an anesthesiologist, and 15% from durable medical equipment providers.

-

28% of spinal surgeries with an out-of-network bill involved a claim for nerve monitoring services, provided by neurologists.

-

-

The largest bills came from surgical assistants, at $4,000–$32,000 per case, and neurologists with an average of $18,600 per case. Durable medical equipment companies issued potential surprise bills of $1,300–$2,300 per case.

iii. Knee replacement, hip replacement, lumbar discectomy, and arthroscopic meniscal repair.

What are the implications for health policy?

As Congress and state legislatures consider different approaches to protect consumers from surprise medical bills, it is important to consider the variety of circumstances and provider types that may lead to surprise bills.

- Our findings suggest that the problem of out-of-network billing is not restricted to a single specialty or to the inpatient setting.

- Although anesthesiologists are frequently cited as a leading driver of surprise bills, we found an equally high rate from surgical assistants.

- In this study, the chance of getting a surprise bill was slightly lower among people in self-insured plans compared to fully insured plans, because large employers may offer plans with broader provider networks. Protecting people in self-insured plans remains an important consideration, since self-insured plans cover the majority of Americans and they cannot be protected by state laws.

- Patients who have complications following elective procedures are at a greater risk of receiving surprise medical bills. This is likely because more providers are involved in their care, increasing their chances of an encounter with an out-of-network provider.

- Following orthopedic procedures, patients may receive out-of-network bills as a result of services provided by third-party companies, including durable medical equipment, physical therapy, and nerve monitoring.

Approaches to address surprise billing should take into account how out-of-network bills may arise in different care settings, such as surgical department care compared to the emergency room.

- Surgical care is inherently multi-disciplinary, always involving providers from different specialties. This may increase the risk of a surprise bill compared to emergency room visits, where the care does not necessarily involve multiple specialists.

Referenced studies

- Out-of-network bills for privately-insured patients undergoing elective surgery with in-network primary surgeons and facilities. Chhabra KR1,2,3, Sheetz KH1, Nuliyalu U1, Dekhne MS3, Ryan AM1, Dimick JB1. JAMA. 2020;323(6):1-10. doi:10.1001/jama.2019.21463.

- “Surprise” Out-of-Network Billing in Orthopedic Surgery Charges from Surprising Sources. Dekhne MS3, Nuliyalu U1, Schoenfeld AJ2,3, Dimick JB1, Chhabra KR1,2,3. Annals of Surgery. 2020;271(5):e116-e118. PMID: 32301796. doi:10.1097/SLA.0000000000003825.

Authors

Karan R. Chhabra, MD, MSc 1,2,3

Kyle H. Sheetz, MD, MSc 1

Ushapoorna Nuliyalu, MPH 1

Mihir S. Dekhne, MS 3

Andrew M. Ryan, PhD 1

Justin Dimick, MD, MPH 1

1 University of Michigan, 2 Brigham and Women’s Hospital, 3 Harvard Medical School

Acknowledgments

This policy brief was supported by the IHPI Policy Sprint program, which provides funding and staff assistance to IHPI member-led teams in undertaking rapid analyses to address important health policy questions and develop products that inform decision-making at the local, state, or national level.

For more information

Please contact Eileen Kostanecki, IHPI’s Director of Policy Engagement & External Relations