One in three Americans with a high-deductible health plan lack a health savings account. This brief outlines policy options that could increase their uptake and help Americans navigate rising health care costs.

Use of Health Savings Accounts to Save for Health Care Expenses

Health savings accounts (HSAs) can be used by Americans who are enrolled in a high-deductible health plan (HDHP) to save tax-free for health care expenses, with the policy goals of lessening patients’ cost burdens and encouraging health care choices that are based on value. Nearly half of Americans with private health insurance are now enrolled in an HDHP.

As the uptake of HDHPs continues to rise and health care expenses grow, expanding the use of HSAs continues to be a frequent focus of health reform proposals. Yet, little is known about who is more likely to have an HSA and how individuals who have HSAs are using them to save for future health care expenses. A research team at the University of Michigan conducted a national survey of adults enrolled in an HDHP to help address this gap in knowledge.i

What is a high-deductible health plan (HDHP)? An HDHP has a higher deductible than a traditional insurance plan and generally covers only certain preventive services before the deductible is met. For 2020, an HDHP is defined as a plan with a deductible of at least $1,400 for an individual or $2,800 for a family.

What is a health savings account (HSA)? An HDHP can be combined with a health savings account, allowing consumers to contribute money on a pre-tax basis to pay for future qualified medical expenses. These include services such as doctor visits for sick care, dental care, glasses and contacts, and prescription co-pays. Any unused funds carry over year to year and never expire.

i A total of 1,637 adults under the age of 65 were surveyed in late 2016. The researchers used the National Health Interview Survey definition of an HSA as “a special account or fund that can be used to pay for medical expenses” that are “sometimes referred to as Health Savings Accounts (HSAs), Health Reimbursement Accounts (HRAs), Personal Care accounts, Personal Medical funds, or Choice funds, and are different from Flexible Spending Accounts.”

Takeaways from our survey*

1. 33% of individuals enrolled in an HDHP did not have an HSA

- Individuals were less likely to have an HSA if they:

- Obtained their health plan through a health insurance exchange, compared to those with employer-sponsored coverage.

- Had lower levels of health insurance literacy or financial literacy.ii

- Individuals with at least one chronic health condition were as likely to not have an HSA as others, despite potential cost-related barriers to accessing health care.

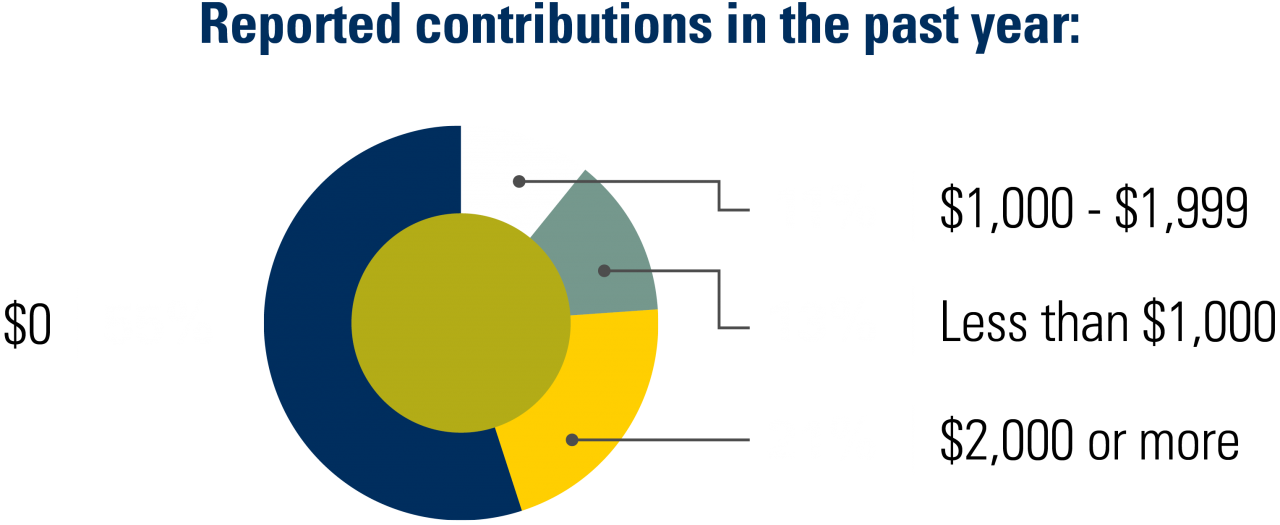

2. 55% of individuals with an HSA had not contributed any money into it

Of the 45% who did make a contribution, 21% reported also using a bank account or Flexible Spending Account to save for health care. For individuals who did not reach their annual contribution limit, this may be financially inferior to the tax advantage of saving using an HSA.

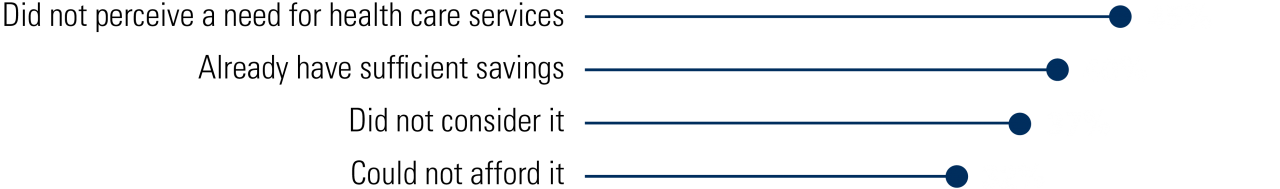

3. Top reasons for not contributing to an HSA in the last 12 months

ii Levels of health insurance literacy and financial literacy were assessed using validated scales.1,2 These factors may play a role in an individual’s choice to save for health care expenses.

What does this mean for health policy discussions?

Findings suggest that few Americans are using HSAs to save for health care expenses. Targeted interventions could encourage the uptake and use of HSAs as a strategy to help more Americans save and navigate the rising costs of health care.

Encourage enrollment in an HSA among those who are eligible for one

Employers: When employers offer HDHPs that are eligible for an HSA, these accounts could be more consistently linked to their health plan at the time of enrollment.

Health plans: Messaging could be targeted to encourage those with an HSA-eligible HDHP to take up an HSA as a strategy to help manage high cost-sharing for health care in an HDHP. These efforts could focus on enrollees who are especially vulnerable to cost-related access barriers and financial burdens, such as people with lower incomes or chronic conditions.

Health insurance exchanges:

- More flexibility could be allowed in the types of health plans that qualify for linkage to an HSA.

- Although the average deductible for a federal Health Insurance Marketplace individual plan was $5,316 during the 2020 Open Enrollment Period, just 7% of Marketplace plans chosen were HSA-eligible.3 This is likely because some Marketplace HDHPs decided to expand the covered pre-deductible services in ways that are not currently allowed in HSA-eligible plans.4

- Extending HSA eligibility to HDHPs that cover specified clinical services on a pre-deductible basis has been implemented in recent IRS regulations for some chronic disease care and for COVID-19 testing and treatment. This HSA eligibility could be further expanded by Congress in proposed legislation.

- The benefits of enrolling in an HSA could be more directly highlighted when someone chooses an HSA-eligible HDHP. Alternatively, HDHPs offered on an exchange could be required to be linked to an HSA

Encourage saving in an HSA

- About 1 in 5 individuals with an HSA who saved for health care expenses reported saving in a non-HSA vehicle along with their HSA, while another 1 in 5 reported saving only in a non-HSA vehicle. These patterns suggest that employers, health plans, financial planners, and banks could use targeted educational messaging campaigns to help individuals with HSAs better understand these accounts and make financially advantageous decisions about saving for health care.

- Employers, perhaps in partnership with financial planners or banks, could facilitate more HSA savings through interventions that have been successful at increasing retirement savings in workplaces.5 These include default contributions to HSAs, employer matching of employee contributions, or committing future wage increases to savings.

REFERENCED STUDY

*Use of Health Savings Accounts Among Americans Enrolled in High-Deductible Health Plans. Kullgren JT, Cliff EQ, Krez C, West BT, Levy H, Fendrick M, Fagerlin A. JAMA Network Open. 2020;3(7):e2011014. doi:10.1001/jamanetworkopen.2020.11014.

OUR PUBLISHED RESEARCH

A Survey of Americans with High-Deductible Health Plans Identifies Opportunities to Enhance Consumer Behaviors. Kullgren JT, Cliff BQ, Krenz CD, Levy H, West BT, Fendrick AM, So J, Fagerlin A. Health Affairs. 2019 Mar. PMID: 30830816. doi:10.1377/hlthaff.2018.05018.

Consumer Behaviors Among Individuals Enrolled in High-Deductible Health Plans in the United States. Kullgren JT, Cliff BQ, Krenz CD, West BT, Levy H, Fendrick AM, So J, Fagerlin A. JAMA Internal Medicine. 2018 Mar 1. PMID: 29181512. doi:10.1001/jamainternmed.2017.6622.

Attitudes About Consumer Strategies Among Americans in High-Deductible Health Plans. Cliff BQ, Krenz C, West BT, Levy H, Fendrick AM, Winkelman TNA, So J, Fagerlin A, Kullgren JT. Medical Care. 2019 Mar. PMID: 30664610. doi:10.1097/MLR.0000000000001056.

ADDITIONAL REFERENCES

1. The Economic Importance of Financial Literacy: Theory and Evidence. NBER Working Paper No. 18952. Lusardi A, Mitchell OS. National Bureau of Economic Research. 2013. http://www.nber.org/papers/w18952.

2. Development of the Health Insurance Literacy Measure (HILM): Conceptualizing and Measuring Consumer Ability to Choose and Use Private Health Insurance. Paez KA, Mallery CJ, Noel H, et al. Journal of Health Communication. 2014;19(sup2):225-239. PMID: 25315595. doi:10.1080/10810730.2014.936568.

3. Health Insurance Exchanges 2020 Open Enrollment Report. Centers for Medicare and Medicaid Services. 2020. https://www.cms.gov/files/document/4120-health-insurance-exchanges-2020-open-enrollment-report-final.pdf. Accessed May 12, 2020.

4. Why 80% of Obamacare plans are ineligible for this tax break. O’Brien E. MarketWatch. 2016. https://www.marketwatch.com/story/why-80-of-obamacare-plans-are-ineligible-for-this-tax-break-2016-03-29. Accessed May 1, 2020.

5. Save More Tomorrow: Using Behavioral Economics to Increase Employee Saving. Thaler RH, Benartzi S. Journal of Political Economy. 2004. doi:10.1086/380085.

AUTHOR

Jeffrey T. Kullgren, MD, MPH, MS

VA Ann Arbor Healthcare System

University of Michigan

CONTRIBUTORS

Elizabeth Q. Cliff, MS

Brady T. West, PhD

Helen Levy, PhD

Mark Fendrick, MD

Angela Fagerlin, PhD

ACKNOWLEDGMENTS

This policy brief was supported by the IHPI Policy Sprint program, which provides funding and staff assistance to IHPI member-led teams in undertaking rapid analyses to address important health policy questions and develop products that inform decision-making at the local, state, or national level.

FOR MORE INFORMATION

Please contact Eileen Kostanecki, IHPI’s Director of Policy Engagement & External Relations, at [email protected].